This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

Student loan debt is a distressing reality for many Americans. In fact, the Federal Reserve Bank of New York reports that there is more than $1.5 trillion of student loan debt currently owed in the United States. While completing both my undergraduate and graduate degrees, I too had to take out loans to cover the cost of tuition, room and board, and the general life expense of being a college student. Leaving me with a significant amount of debt following graduation and into a recession in 2009. However, by working hard and taking small steps, I was able to use my Door Dash earnings strategically and pay off close to $20k in a student loan within 17 months! Though it wasn’t easy, breaking free from this debt felt like an incredible accomplishment.

In this article you’ll find…

-

- How To Pay Off Large Student Loan Debt

- How To Pay Off Student Loan Debt in Months not Years

- DoorDash earnings for Q2

- How To Pay Off Student Loan Debt in Economic Hardship

- Best Practices When on a Debt Repayment Journey

- How to Stay Positive when Paying off Student Loan Debt

- Questions to Ask Yourself Before Starting a Personal Finance Challenge

- Resources mentioned in video

How To Pay Off Large Student Loan Debt

Identify what the underlying issue is first

The first step is to identify the root of the problem. After paying off credit card debt, medical bills, and a car note, I realized that I was still struggling financially each month. So my issue wasn’t overspending—it was underearning.

According to recent data, Millennials are only 80% as successful as their parents were at the same age. By the age of 40, Millennials in the United States are worse off than previous generations.

Before beginning, this challenge, set aside at least $1000.00 in an emergency fund so you’re not blindsided by unexpected expenses and compelled to end the challenge early.

When Paying off Student Loan Debt, What Should You Pay First?

Prioritize which student loan to pay off first if you have several. Choose the one with the highest interest rate or a variable interest rate, the one with a co-signer and the one that is Private and not Federal; depending on your situation, one loan could comprise of all four. If you have Federal student loans, you’re in luck because in addition to the payment pause on Federal student loans, there are also several new flexible repayment alternatives and interest cap policies accessible to you, including $10,000.00 in student loan forgiveness for all Federal Student Loan borrowers, introduced by the Biden Administration and a variety of other professional student loan forgiveness programs. If you have only Federal loans, it’s critical that you investigate all of the advantages available to you as a federal student loan borrower before paying them down the traditional way.

On March 27, 2020, Federal Student Loan repayments were initially paused through September 2020 via the CARES Act in response to the COVID-19 pandemic. Therefore borrowers holding Federal Student loans did not have to make any payments during this time because their loans had been placed on an administrative forbearance at a 0% interest rate.

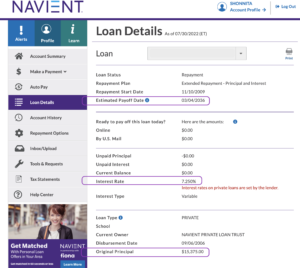

This news was unheard of for me, and it was a game-changer financially. Because I have both Private and Federal student loans, this was the ideal moment to get a handle on my debt. Temporarily this meant that I could finally have the relief I needed to not worry about my Federal student loans and just focus on a strategy to repay my Private student loans. Unlike Federal student loans, Private loans are ineligible for the Administrative Forbearance payment pause or Public Service Loan Forgiveness (PSLF), and they can not be discharged in bankruptcy. There was nothing else I could do but accept that I would never have another chance like this again.

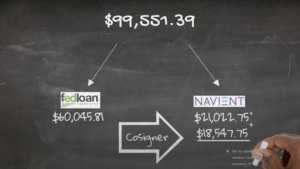

I had three student loans during the time of this challenge. Two were Private Student Loans with Navient, and the other was a consolidated Federal Direct Loan with Fed Loan Servicing.

I chose to pay off the Private Student Loan with Navient first because not only did it have the highest interest rate of my loans, but a co-signer was also attached to it. My Direct Loan with Fed Loan Servicing was on an administrative forbearance due to the COVID-19 global pandemic.

How To Pay Off Student Loan Debt in Months not Years

While it may seem daunting at first, taking on $100k of student loan debt can be psychologically beneficial. By preparing yourself mentally for the task ahead, you can help set yourself up for success. Consider some of the potential benefits:

- The faster you pay down your student loan debt, the sooner you’ll get your life back.

- You’ll have more money available each month to save and invest.

- You’ll feel a great sense of accomplishment when you finally become debt-free.

- When you’re free to do what you want, life is more fun than working day-in and day-out just to make ends meet.

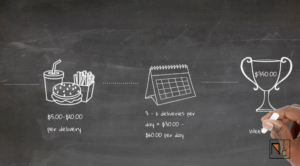

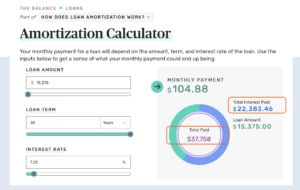

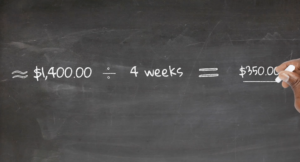

However, I had to realize that those benefits would not come without sacrifice. In exchange for my financial freedom, I was going to need to trade off 12 months of my free time (which later became 17 months) in order to do side-hustle gigs, to make the minimum I needed to contribute to an overpayment for my student loan. Otherwise, the alternative would be to spend the next 15 to 20 years working just to pay the interest on a $15k loan.

It’s crucial to remember that gig economy jobs are not a form of passive income. So if you’re looking to pursue this method to earn an extra income, you will have to set aside a few hours each day or week, specifically for working in order to generate enough income.

Of course, the best types of income are passive, such as real estate investing, low maintenance high yield investments, creating an online course, or selling an ebook on Amazon. But those require more considerable up-front investments, which I didn’t have at the time.

But if you’re like me and you need to start somewhere, the gig economy is a great place to get your feet wet.

Use amortization calculators to help you plan for your future and paint a full financial picture of different “what-if” scenarios. There are several calculators online that can do this, and I shared one with you in a previous post. Here’s another one for you to check out!

My Loan Details:

My results from The Balance:

How to Pay Off Student Loan Debt When you Live Paycheck to Paycheck

Find an Additional Income Source

Now that you are entirely knowledgeable about your specific financial situation, and you have a small emergency fund in place of at least $1000.00, you can make level-headed decisions on your next steps. Feel free to use my Income Strategy Guide to plan a daily, weekly, or monthly earnings goal. I did so in this previous post if you’re looking for an example.

Door Dash Earnings for Quarter 2

My income with Door Dash has significantly increased from last year due to:

- The lift of COVID-19 restrictions

- More time spent dashing instead of using it for content creation

- Restaurants that survived the pandemic were able to rebound with cheaper consumer alternatives

2022 Q2 Total Door Dash Income: $4,004.17

| April | May | June |

| $962.89 | $1,429.93 | $1,611.35 |

When reviewing my numbers in the Stride App: $4,413.62 appears to be my company’s net profit so far.

2021 Q2 Total Door Dash Income: $2,434.38

| April | May | June |

| $1,494.82 | $523.61 | $415.95 |

How To Pay Off Student Loan Debt in Economic Hardship

There are several factors that can hinder your ability to pay down your debt such as:

- Losing your job

- An emergency fund that isn’t large enough to cover all of your expenses

- Unexpected medical bills

- A decrease in income

But there are several other variables that are more dependent on the present condition of the economy than your personal life circumstances. These include:

- Inflation – The cost of goods are increasing but wages remain the same. Many restaurants experienced this after the lockdown from the pandemic. Where the cost of the items to make the products they sell, has become increasingly more expensive than last year. As a result, the items that we buy are also increasing. To start solving this problem, take an inventory of what you already have in your kitchen. Perhaps you have some food in your cupboards that you’re not entirely thrilled about eating. It’s time to make a change and create a grocery list around those items so that you can buy groceries accordingly. This way, nothing goes to waste! This is an excellent exercise to help you get more acquainted with the contents in the far back of your cabinets while also becoming more aware of your grocery shopping practices and eating habits. It will also encourage you to be more inventive and experiment with new recipes, which will help you eat the things you don’t usually prefer rather than dining out.

- Gas Prices Are on the Rise – And the average price of a gallon of gas is now $0.30 higher than it was just a few weeks ago. This may not seem like much, but it can add up quickly. Using software like the Waze App, which has built-in gas station evaluations, can help you save money on gasoline. In a prior post, I discussed some of my favorite applications that have helped me to stay organized when traveling. Aside from Waze, consider how many miles you’re driving in relation to the amount earned per delivery. This will help alleviate your inclination to take every offer available and instead, focus on Door Dash deliveries that’ll maximize your business profit. Here’s what I do to carry this out most effectively.

- Rising Interest Rates – This can have an impact on your ability to pay off your student loan debt. If you have a variable interest rate, your monthly payments could go up if rates continue to increase. And if you’re trying to refinance your student loans, you may not be able to get as low of a rate as you had hoped. Private student loan interest rates are set by the lender, whereas Federal student loans are set by congress. Factor this information in before deciding to consolidate both Federal and Private loans into one loan.

Best practices when on a debt repayment journey:

- Begin modestly. And, if necessary, simplify it even more. I discovered that lowering the bar and working my way up gradually was the best approach for me. $30.00 a day adds up to over $10,000 throughout the year.

- Don’t be discouraged if you find yourself straying away from your financial goal, it happens. I certainly did when I started my journey to becoming debt-free. Pick yourself up and start over as many times as necessary. Before long you will find that you’ve made enough progress to take on bigger goals like 5 and 6-figure student loan debt.

- Remove temptations, get rid of subscription services and anything that makes you feel like what you have is not enough.

- Make a digital record of the things you desire, to keep track of what you want and why. The Karma app is ideal for recording my “Wants” and “Like-to-have” lists, which I maintain with my smartphone. However, this might divert your objectives if you use the app too frequently. To avoid being tempted to check your wants list too often, make sure to adjust your notification settings for these sorts of applications.

How to Stay Positive when Paying off Student Loan Debt

Do you need a boost? Here’s what happens once you’ve completed your debt repayment journey:

- You may begin to shift your attitude by reminding yourself that you have the option of doing nothing now, in which case you can’t lose. And therefore you learn to appreciate your free time much more.

- When you’re dedicated to your own journey, you’ll have less time to concern yourself with other people’s opinions.

- You’ll no longer say things like, “I can’t afford it,” and start asking more questions like, “How can I afford this?” “What will it take to be able to afford this?” and “How long will it take to afford it?”

- You’ll become more intentional about your purchases. Have you ever noticed how many people who are debt free, own less? It’s because they’ve compartmentalized the effort it took to get them out of that financial bind in which they accumulated so much stuff in the first place.

Would I recommend this type of financial journey to someone else?

I would rather suggest the steps I took to get where I am than tell you to do exactly what I did.

Begin with a quick self-assessment by answering the following questions:

- Can you handle sacrifice and discomfort for an extended period of time?

- Do you have a solid income that can cover all of your expenses?

- Are you willing to make some changes to your lifestyle and spending habits?

- Do you think you could benefit from learning more about how to manage your money?

- Could you use some extra cash flow each month?

- Would becoming debt free reduce stress in your life?

- Do you have other financial obligations or personal priorities that would make a challenge like this much harder or unrealistic?

If you answered yes to any of these questions (with the exception of the last one) then I would say that a debt-free challenge is worth considering. However, if you find it difficult to answer these questions, start with a modest personal finance target to get your first win under your belt, and then work your way up. If you’re looking for more specific guidance on how to get started, check out my Income Strategy Guide on the subject.

Overall, I learned a lot from this experience and it help me develop better spending habits. If you want to do something similar, make sure you can handle the workload and plan accordingly. And if things get tough, don’t hesitate to restart! You got this!

Resources Mentioned in Video:

The Balance Amortization Calculator