This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

Do you need to make some extra money? If so, you should consider doing Door Dash food delivery service! This is a great way to make some extra cash, it’s really easy to do and it’s a great way to apply the extra money toward your debt.

But wait… how do you apply an overpayment to a student loan balance?

In this blog post we’ll discuss how the Door Dash food delivery service platform works and how to properly apply your overpayments when your income changes each month.

What is Door Dash?

Door Dash is a food delivery service that partners with restaurants in your area. Customers order food through the Door Dash app and then a Dasher (that’s you!) picks up the food and delivers it to the customer. You get paid for each delivery, plus tips! It’s a great way to make some extra money, especially if you’re already working another job or going to school full-time.

What is a Door Dash Dasher?

A Dasher is a food delivery person who partners with Door Dash as an Independent contractor (sole proprietor) to deliver food from restaurants to customers using their preferred mode of transportation via it vehicle or bike.

What is a student loan overpayment?

When it comes to student loans, an overpayment is any amount of money that you pay above and beyond your required monthly payment. Applying extra money toward your student loan balance can help you pay off your debt faster and save you money on interest charges. But how do you know how much to apply? And what do you do if your income changes from month to month?

Well, if you’re making extra money from gig work like Door Dash, the best thing to do is apply that money toward your student loan balance each month. You can either make an additional payment on your existing student loan bill or you can make an overpayment directly to your student loan servicer.

Acknowledging privileges:

Before I go into how much money I made with Door Dash in January, let me start by stating that my financial situation is unique, and I am well aware that everyone’s are too.

Because I don’t have any further consumer debt, the majority if not all of my side hustle earnings can be utilized to pay down my student loan debt. I do not have a credit card, automobile loan, mortgage or any medical bills that would take priority over paying down my student loan debt.

How much money can you make as a Door Dash Dasher?

Frequently Asked Questions:

- How much do you make per order? My typical delivery payout is between $8.00 and $12.00 per order.

- How often do you Dash? I deliver for Door Dash part-time, an average three to five food deliveries per day.

- How much do you make per day? On average I make about $46.00 for about 3.5 hours of delivery time.

- How much do you make per week? Weekly earnings come out to be between $300.00 to $350.00 per week.

On some days, business may be slower than others, causing weekly earnings to be smaller. This really varies depending on when and where you deliver. However, according to Door Dash’s calculations, here’s what they say:

✔ Dashers who deliver for 5 hrs/week get paid an average of $104

✔ Dashers who deliver for 10 hrs/week get paid an average of $208

✔ Dashers who deliver for 20 hrs/week get paid an average of $415

✔ Dashers who deliver for 40 hrs/week get paid an average of $831

Keep in mind that you also have the opportunity to earn tips, which can really add up!

What are the conditions to be a Independent Contractor with Door Dash?

To become a Dasher, you must be 18 years or older, have access to a mode of transportation (bike, car, scooter), and pass a background check. You will also need to provide your Social Security Number (SSN) in order to run the background check.

How do you get started with Door Dash?

The sign-up process is pretty simple and straightforward. Just go to the Door Dash website and sign up with your email address or phone number. Once you’re signed up, you’ll need to download the Door Dash Dasher app and complete your profile. Then you’ll be ready to start accepting orders!

What are the criteria to saying on as a Dasher with Door Dash?

Here are some criteria in order to remain on the Door Dash platform:

- you’ll have to have at least a 4.2 customer service rating

- with a completion rating of at least 80%

Because you are considered an independent contractor, you decide what orders you would like to accept as well as how many orders you would like to accept in any given day. Therefore, there is no minimum acceptance rate that you have to have in order to stay on the Door Dash platform.

For Latest Updates on Dasher Ratings Visit: https://help.doordash.com/dashers/s/article/Dasher-Ratings-Explained?language=en_US

How do you get paid with Door Dash?

You can choose to be paid via direct deposit, PayPal, or DoorDash DashPass. I personally get paid via direct deposit because it’s the quickest and easiest way to receive your earnings.

How often do you get paid with Door Dash?

You can choose to be paid weekly or daily with Door Dash. If you choose to be paid weekly, you will receive your earnings every Monday for the week prior.

Total Door Dash earnings – January 2020 vs January 2021:

| January 2020 | January 2021 |

| $1,296.05 | $1,124.71 |

How to allocate an overpaymennt to your student loan balance?

While I only have examples of how to make an overpayment using Navient’s payment portal (because they are my student loan servicer) the below illustrations are assuming many student loan payment systems, are similar. And if they aren’t, hopefully these steps will point you in the right direction on what to look for and the questions you should be asking your loan servicer.

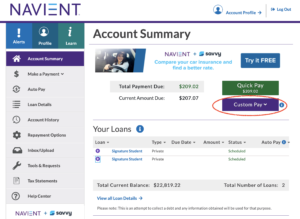

When signing into to the Navient student loan servicer platform, begin by selecting your payment option from the drop down menu.

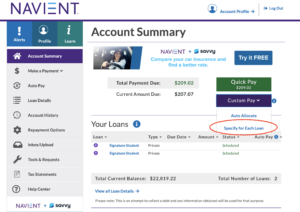

From here, select that you want to apply your overpayment by clicking: “Specify for Each Loan”.

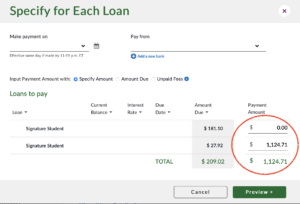

Now that you’ve selected the option to specify your overpayment. You can now decided how much of an overpayment you would like to apply to your student loan. In my case, since I earned $1,124.71 for the month of January with Door Dash, I will be allocating all those earnings to one of my student loans.

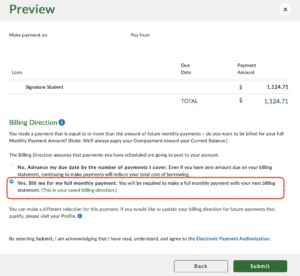

Navient gives you two different options on how you want to allocate your overpayment.

- The first option says to: “Advance my due date by the number of payments I cover.”

In other words: If you make more payments than you owe, your due date will be advanced. This means you’ll pay less interest in the long run. Even if you don’t have any amount due on your billing statement. Essentially all you are doing for this option is making payments in advance. This payment option does not significantly contribute to the principal balance of your loan.

What is a principle balance?

The principle balance is the original amount of your student loan.

What is interest?

Interest is what you pay to a lender for the use of money borrowed.

- Because I am trying to pay down the principal balance of my student loan I chose to select the second option: “Bill me for my full monthly payment.”

In other words: Whatever balance you owe for next month will still be due as a standard monthly payment requirement, even though you are making a larger payment currently. Provided that you’ve already made your standard monthly payment prior to making your overpayment, this option is acknowledging that this payment will be applied to the principal of your outstanding loan balance.

Once you are satisfied with your selections you can then click on the “Submit” button. And you’re all set, it’s that easy!

Why are overpayments on your student loans helpful?

Making an extra student loan payment each month can help you pay off your debt faster and save you money on interest charges. In fact, if you’re able to make even just a small overpayment each month, it can really add up!

Here’s an example:

Let’s say you have a student loan balance of $20,000 with an interest rate of six percent. If you make the minimum monthly payment of $200, your repayment term will be approximately 25 years. But if you make an additional student loan payment of just $20 each month, you can pay off your student loans in less than five years and save more than $14,000 in interest charges!

So if you’re looking for ways to make extra money to pay down your student loan debt, Door Dash delivery is a great option. Just remember to apply your earnings towards your student loan balance each month. And if your income fluctuates from month to month, be sure to adjust your student loan payments accordingly.

If you’re looking for more tips and tricks on how to get out of student loan debt, be sure to grab the FREE, Side Income Strategy Guide on how to build a additional 1k in side-income.

I hope this article helped explain how Door Dash food delivery works and how it can help you with student loan debt repayment as well as learning how to apply your overpayments once you’ve gotten paid from Door Dash. If you have any questions, please feel free to leave a comment below and I will get back to you as soon as possible. Happy dashing!