This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

There are two popular budgeting theories often talked about in the personal finance community: the 70/20/10 budget and the 50/20/30 budget. Both of these budgets have their pros and cons, so it can be difficult to decide which is best for you. In this blog post, we will break down each budget and help you decide which one is right for your needs and I’ll show you what my monthly budget looks like. And which one of these budgets I prefer.

What is a personal budget?

A personal budget is a plan that allocates your income towards expenses, savings, and debt repayment. A good budget will help you track your spending, save money, and get out of debt.

What is the best way to organize your money?

It depends on your circumstances and what your financial goals are. People budget in several different ways, some people use planners, and others use Excel spreadsheets. I’ve personally enjoyed using the envelope method, but if you prefer the paperless route, try exploring mobile budgeting apps. Sometimes you don’t even need to download a budgeting app, many banks now offer apps that have budgeting software included so you can see all of your debit card transactions categorized to capture your spending habits. You can try also the old-school pen, and paper method, money jars are quite popular for those that like visual incentives. Calendars are a great way to stay ahead of important one-off spending events, like birthdays, baby and wedding showers, and then some people just keep track of their spending in their head.

Budgeting doesn’t have to be difficult or boring. There are a lot of different ways to budget and many different budgeting methods that you can try. The important thing is to find a method that works for you and your unique circumstances.

Which budget strategy is best for you?

What’s the best way to budget?

How do you know if you’re doing it right?

Is there a wrong way to budget?

All of these are difficult questions to answer. The truth is, budgeting is a very personal thing and what works for one person, may not work for another.

But some general guidelines can help you figure out if your budget is on track.

For example, the 70/20/10 budget:

This budgeting method is where you would allocate 70% of your income to essentials, like housing, food, and transportation.

20% would go towards debt repayment and savings.

And the remaining 10% would be for tithing, donating, and miscellaneous spending.

Who is this budget good for?

This is a great budget for people who are working on getting out of debt and building their savings.

It’s also a good budget for people who want to make sure they are staying on track with their financial goals.

How do you calculate 70% of your income?

To calculate 70% of your income, you would take your total monthly income and multiply it by 0.70. This will give you the amount of money that you should allocate towards essentials each month.

For example, if your monthly income is $2000, then you would budget $1400 for essentials.

Now, let’s take a look at the 50/20/30 budget:

This budgeting theory is a little different. With this budget, you would allocate 50% of your income to essentials (or your needs), 20% to debt repayment and savings, and then 30% would be for your discretionary spending (or your wants).

This budget is a good option for people who have a higher income and want to have more flexibility with their spending.

How do you calculate 50% of your income?

To calculate 50% of your income, you will first need to figure out your after-tax income. Once you have your after-tax income, simply multiply it by 0.50 to get 50% of your budget.

For example, if your after-tax income is $2000, 50% of your budget would be $1000.

Who is this budget good for?

This is a good budget for people who are already out of debt and are working on building their savings.

The Pros and Cons of the 70/20/10 Budget and 50/20/30 Budget:

70/20/10 Pro & Con Key Takeaways:

Pro:

- Others find that this budget is a great way to get out of debt and start saving money.

Con:

- Some people find that this budget is too restrictive and doesn’t allow for any fun or wiggle room.

I find that this budget is a great way to stay on track with my financial goals and save money each month so that I don’t feel like I’m depriving myself of anything. So, if you are working on getting out of debt, the 70/20/10 budget may be a good option for you.

50/20/30 Pro & Con Key Takeaways:

Pro:

- Some people find that this budget helps them stay on track with their spending and they can save money each month.

Con:

- Others find that this budget gives them too much leeway and they end up overspending.

I find that this budget is a great way to stay on track with spending while being able to save money each month. If you have a higher income and want more flexibility in your spending, the 50/20/30 budget may be the better option between the two.

So, which budget is best for you?

As you can see, there are pros and cons to both budgeting methods. It really depends on your individual circumstances and what your financial goals are. If you’re trying to get out of debt, then the 70/20/10 budget may be a good option for you. If you’re trying to save money, then the 50/20/30 budget may be a good option for you.

What’s in my budget?

To demonstrate how I will integrate my side income earnings into my overall monthly personal finance objectives, I walked you through my Door Dash profits for January.

So here’s what my budget looks like on a month-to-month basis. Not too sure I’ll be doing monthly budget posts, given that my spending habits are pretty regimented, my income is pretty consistent and my expenses are pretty predictable as well.

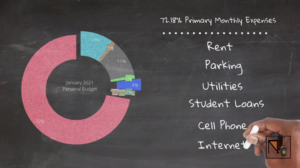

In January, approximately 72% of my income was spent on utilities. My monthly rent, typical student loan payment (not overpayments), cell phone bill, and internet costs are included.

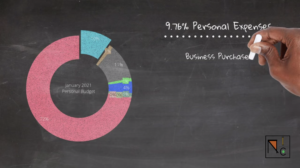

9% was spent on miscellaneous one-time purchases.

10% was spent on online purchases.

My other personal expenses include:

- 1% = eating out

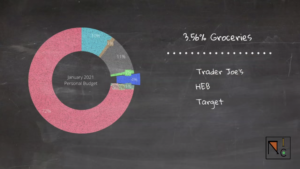

- 3.5% = groceries

- 0.3% = transportation expenses / parking

- 1% = gas 0.95%

- or less than 1% = subscription services

- 1.8% = health and wellness

For January, the monthly expenses were pretty straightforward. They don’t fluctuate all that much. I may have a different budget for February since I got braces in February and it was done during February.

So which budget method do I use?

After completing this document, my spending appears to follow a conventional 70/20/10 budget. And I believe that’s correct since a 70/20/10 budget is more for someone like me who has student loan debt and other financially straining personal circumstances and can’t afford to spend so much on miscellaneous expenses.

Only you can decide which budget is best for you. But whichever budget you choose, make sure to stick to it and stay on track with your financial goals!

What do you think? Comment below and let us know which budget is best for you!

Do you have a budgeting method that you love? Share it with us in the comments below!