This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

Making overpayments on your student loans can be a great way to get ahead of your debt and save money on interest. However, many people don’t know how to get started. In this blog post, we will outline six steps that you need to take to begin making overpayments on your student loans!

This is when things start to get fun for me (I know, I probably need to get out more)! The planning has begun! We’re making progress now that we’ve acknowledged some of the negative habits that will prevent us from achieving our financial goals.

The first step is to: Identify the three main elements of your student loan term agreement:

- Your Student Loan Lender

- Your Student Loan Servicer

- Your Student Loan Repayment Plan

What is a student loan lender?

A student loan lender is an organization that provided the funds for your student loan. The student loan lender can be a bank, credit union, state agency, an educational institution (an example of this would be if you have Health Education Assistance (HEAL) program loans), or the federal government (an example of this would be if you have Federal Family Education Loan Program (FFELP Loans) consolidated into a Direct Loan).

What is a student loan servicer?

A student loan servicer is a company that handles the billing and collection of payments on your student loan. Your student loan servicer will also help you with things like deferment and forbearance if you need it.

Some of the most commonly known Student Loan Servicers are:

- Great Lakes Educational Loan Services

- Nelnet

- Navient

- Mohela

- FedLoan Servicing (Also known as Pennsylvania Higher Education Assistance Agency or PHEAA)

There are many others, but these five student loan servicers service the vast majority of student loans.

Your student loan servicer will also be the company that you contact if you have questions about your student loan or need to make changes to your repayment plan.

What is a student loan repayment plan?

A student loan repayment plan is the way that you will repay your student loans. There are many different repayment plans available, and you can switch between them if your circumstances change.

So, if you have federal loans as I do (FedLoan Servicing), the first step is to access the National Student Loan Data System to discover all of the federal student loans that you signed off for while in school.

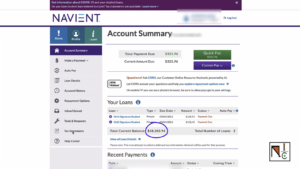

If you have private student loans, as I do as well (Navient), the first step is to access your credit report to discover all of the private student loans that you may have taken out while in school.

How to access a credit report:

You are entitled to one free credit report from each of the three major credit bureaus- Equifax, Experian, and TransUnion- every year. You can request your free annual credit report online at AnnualCreditReport.com. When requesting your report, you’ll need to provide your name, address, Social Security number, and date of birth.

From there, you’ll be able to see a list of all the student loans that you have and who your student loan servicer is for each one.

If all else fails, go to your financial aid department at the institution or trade school at which you obtained your degree or certification.

You may come across many terms such as lender, servicer, or guarantor when looking at your financial information on these reports. Keep in mind the various phrases that are used when researching this data. Since we’ve already looked at who your lender and servicer are, I’ll go through what a guarantor is for you:

What is a guarantor?

A student loan guarantor is an organization that protects the lender against borrower default. The federal government acts as a guarantor for Direct Subsidized and Unsubsidized Loans, PLUS Loans for Parents and Graduate or Professional Degree Students, and FFELP student loans which are federally backed student loans originally funded by private lenders (these FFELP loans are then commonly consolidated into Direct Loans, which then qualify for the Public Service Loan Forgiveness (PSLF) program). A few state governments also act as student loan guarantors.

Now on to Steps Two & Three: Do the math and calculate your overpayment amount and payoff date

Now that you know who your student loan lender, servicer, and guarantor are, as well as what repayment plan you’re on and how much you owe, do the math and calculate your payoff date. Determine how much of a monthly overpayment you can make each month to quickly pay down your debt.

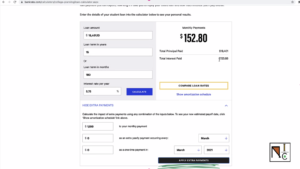

Now there are many different student loan debt repayment calculator tools out there that can help you with this but my personal favorite is the Bankrate student loan calculator.

To use this calculator, you’ll need three pieces of information: I’ll emphasize that it’s better not to guess this data since you want the calculator to provide an accurate calculation of how long it will take you to pay off your student loan.

Here’s what you’ll need to know:

- The exact loan amount as of your last payment

- The loan term and either months or years

- And your interest rate

You can find all of this information on your most recent student loan statement or by logging into your student loan servicer portal.

However, if you have a variable interest rate like I do. Simply input the current interest rate as it’s shown to date. This should be even more incentive for you to try to pay it off as quickly as possible given the economic climate as a result of the pandemic and the Cares Act applying an administrative forbearance on federal loans. The interest rates on current outstanding debts are lower, and therefore larger payments are easier to make while the principle is still being repaid at a reasonable rate of interest.

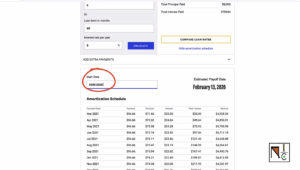

Now type in the overpayment amount you would like to apply monthly, put in the month that you would like to start making the overpayment, then click on, the “Apply Extra Payments” button.

This calculation will allow you to see your full payment schedule. And then it gives you a breakdown of how long it’ll take you to reach zero.

In my case, I’d like to try to get this done in 12 months. So I’ll continue to adjust the payments in the calculator until my results reached zero in about 12 months.

But if you’re curious and would like to try and do the math manually yourself, here’s how:

This is the student loan payment formula to calculate your monthly student loan payments:

P = L[c(I(i + n))]/[(i + n)]

P = your monthly student loan payment

L = the amount of your student loan

i = your student loan’s interest rate

n = your student loan’s term length in months

Now that you know how to calculate your monthly student loan payments manually, you can use that information to figure out how much of a monthly overpayment you can make.

To do that, simply subtract your monthly student loan payment from your monthly income.

For example, let’s say you make $3000 a month and your monthly student loan payment is $250. That means you have $2750 leftover each month that you can put towards an overpayment on your student loans (however, in a perfect world, this example is implying that you have no other financial obligations).

So now that we’ve calculated all of this, how do we raise the extra money to make these overpayments?

Next is Step Four: Earn extra money by doing side gigs

My Bankrate student loan calculator results say my overpayment amount will be about $1,400 a month. This is in addition to my standard monthly repayment. That means if I want to come up with an extra $1400 each month, I’m going to have to figure out a way to make $350 per week over four weeks.

$350.00 x 4 (weeks in a month) = $1400.00

To reach a $350 weekly target, I’d have to make between $30.00 and $50.00 each day to meet it. In my opinion, the more likely scenario is $50.00 per day, but that may be tough given the time commitment it takes to reach that goal of doing a daily delivery with Door Dash part-time. So I’m setting my expectations at a set goal of $30 a day. And then maybe I can pick up some extra hours during the weekend.

Now it’s time to decide how to make that overpayment.

Step Five: Develop a plan to pay

You’ll need to be strategic about when to assign your overpayments to make sure your overpayments are going towards the principal and not future interest. There are some experts and articles out there that suggest you make your overpayments every two weeks.

But I’ve found that making bi-weekly payments doesn’t work for me because my paychecks come monthly. So instead, I make an extra student loan payment at the beginning of each month.

The key is to be consistent with your overpayments. If you can only afford to make a $50 overpayment one month, that’s OK. The goal here is to try to just increase the amount you’re paying each month so you’re making headway in reducing the principle, you can work your way up to larger overpayments over time as you begin to incorporate this into your overall household monthly budget.

Here are two articles that talk about making overpayments either biweekly or at the end of the month.

- TaxAct’s Every Two-Week Overpayment Plan Article: 3 Hacks to Pay down Student Loan Debt Faster and with Less Interest

- Forbes Advisor’s Once Per Month Overpayment Plan Article: How To Pay Off Student Loan Debt

Now that we’ve done all this hard work, the very last step to all this is to visualize a future without any student loan debt. Keep in mind that none of the steps that I mentioned are actionable if you don’t truly believe that you can achieve them.

Step Six: Visualize your future without student loan debt

The realization for me was when I took a trip to Thailand and I met several other women who were from all parts of the United States and United States Territories. I wondered to myself, what would this be like, if I could do this anytime I wanted? That kind of got the ball rolling for me and I realized that if I liked this type of lifestyle of meeting people, taking time off when I wanted, and enjoying my time to learn from others, what that would be like for me.

It became clear to me how important it was to get out of the situation that I’m in now, to fulfill the type of lifestyle I wanted for myself and my family later on.

Keep in mind that the steps I’ve provided are a guide, and your situation may be different. The most important thing is that you remain flexible, innovative, and committed to getting rid of your student loan debt as quickly as possible because your future self will thank you.

I hope this was helpful and as always, stay motivated and keep hustling!