This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

It’s no secret that having straight teeth makes you look and feel better. Invisalign and traditional braces are both great ways to achieve this, but they come with different price tags. How do you know which option is best for you? And more importantly, how do you afford it? Well, in this blog post, we will break down how to budget and save for Invisalign or traditional braces, as well as the benefits of each option. We’ll also discuss why it’s so important to take care of your teeth and get them straightened!

What is Invisalign?

Invisalign is a clear aligner system that gradually moves your teeth into place. It is virtually invisible, and therefore, many people prefer Invisalign over traditional braces. Invisalign is also removable, which means you can take them out to eat and brush your teeth with ease. However, Invisalign is generally more expensive than traditional braces. The cost of Invisalign varies depending on your specific case, but it typically ranges from $3000 – $5000.

If you’re thinking about Invisalign, there are a few things you can do to budget and save for your treatment:

- First, see if your dental insurance covers any of the costs. Many dental insurance plans will cover a portion of Invisalign, so it’s definitely worth looking into.

- Ask your orthodontist about financing options. Many orthodontists offer in-house financing or payment plans to make Invisalign more affordable.

- Get a quote and an estimated time frame on how long the treatment will be, so that you know long you will be given to pay off the balance of the treatment.

- Decide if your lifestyle and habits are suited for Invisalign. Invisalign is not for everyone, and it’s important, to be honest with yourself about whether or not you will be able to keep up with the required maintenance.

What are traditional braces?

Traditional braces, on the other hand, are metal brackets that are bonded to your teeth. They’re less expensive than Invisalign but more visible. Traditional braces are also not removable, which means you have to be careful about what you eat and how well you brush your teeth.

However, the reason why I switched from Invisalign to traditional braces was that I quickly realized they are generally more effective in correcting more complex dental problems. The cost of traditional braces also varies depending on your case, but it is typically cheaper than Invisalign, costing anywhere from $2000-$4000.

Invisalign vs Traditional Braces Expense Breakdown:

| Invisalign Comprehensive Braces | Traditional ComprehensiveBraces |

| $5,951.00 | $3,999.00 |

| – $1,503.00 (Promo Discount Applied) | – $1,000.00 (Promo Discount Applied) |

| Total: $4,448.00* | Total: $2,999 |

*3424.44 – refunded

To budget and save for traditional braces, you can follow many of the same tips as Invisalign:

- See if your dental insurance plan covers any of the cost.

- Ask your orthodontist about financing options or payment plans.

- Get a quote and estimate how long the treatment will take so that you can budget accordingly.

Why it’s so important to take care of your teeth and get them straightened?

Aside from the obvious aesthetic benefits of having straight teeth, there are also many health benefits.

- Having straight teeth makes it easier to brush and floss properly, which leads to better oral hygiene overall. Good oral hygiene has been linked to a lower risk of heart disease, stroke, and other health problems.

- Straight teeth can also help you bite and chew more efficiently, which can lead to better digestion.

- Straight teeth also help to reduce wear and tear on your teeth, as well as the likelihood of developing gum disease.

Overall, your mouth is a pretty good indicator of your overall health.

So, if you’re looking to improve your oral health (and overall health), Invisalign or traditional braces may be something worth considering!

Ways to save up for orthodontic therapy:

Once you’ve decided which option is best for you, it’s time to start saving! Many people like to set up a dedicated savings account for their orthodontic treatment. This helps to stay on track financially and avoid spending the money on other things. No matter which route you decide to go, it’s important to start saving early. Here are a few things you can do to budget and save for your treatment.

- Tax-advantaged savings plans like a flexible spending account (FSA) or a health savings account (HSA). These accounts allow you to set aside pre-tax dollars to use for qualified medical expenses, including orthodontic treatment.

- Also look into dental savings plans, which are similar to insurance but usually much more affordable. These plans allow you to pay a yearly fee and receive discounts on dental services, including braces.

- Many orthodontists offer discounts for cash payments or offer seasonal promotions that can significantly reduce out-of-pocket costs. So be sure to ask about that.

After I finished paying for my orthodontic treatments in full. It cost a little more than half of my monthly budget for the month. Which is a big difference between my budget reporting in my last post.

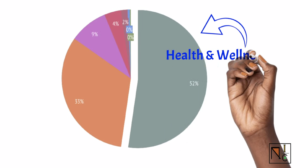

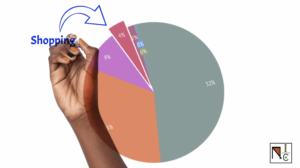

Other expenses for the month include:

- 32.52% = bills and utilities (rent, utilities, parking, student loans, cell phone and internet)

- 9.01% = personal expenses

- 3.91% = online shopping

- 1.54% = groceries (Walmart trader Joe’s target)

- (less than) 1% = professional services

- 0.49% = business expense

- 26% = petrol/ gas

If you’re wondering how I arrived at my monthly budget percentages, I’m currently banking with Chase. Chase mobile app and desktop both provide a view spending summary for each month broken down into percentages with the precise amount of money that you spend in each area.

I hope this post was helpful, and if you have any questions or tips of your own on saving for Invisalign or braces, please share in the comments below!

Take care!