This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

Door Dash earnings in February can be a little unpredictable. And admittedly Door Dash earnings this month were a little on the low side. This could be due to a number of reasons: people out of work, businesses closing due to the pandemic, etc. But that doesn’t mean you can’t make extra money with Door Dash! In this blog post, we will discuss some tips on how to maximize your earnings during this time. We will also talk about ways to prepare for driving when business is slow, and how to handle winter shutdowns. Finally, I’ll be sharing my Door Dash earnings for the month of February, and how I use Door Dash to pay down my student loan debt!

What you should know:

Now that you know how I performed in January by utilizing Door Dash, you should have a basic understanding of how the Door Dash Dasher platform works and what the requirements are to remain on it. You’ll need to meet these criteria in order to maintain a consistent source of income with Door Dash. Now let’s talk about winter shutdowns.

How to prepare for natural disasters when you use gig work as a source of income:

A devastating winter storm raked the entire state of Texas, leaving devastation in its path. Because the infrastructure was not adequately prepared to deal with that sort of weather, hundreds of thousands of people were left without power and many without running water. This meant that a lot of businesses had to close their doors, which in turn led to a decrease in Door Dash orders. Many states have laws that require businesses to close during extreme weather conditions, so it’s important to be aware of these laws in your state.

So, what can you do to prepare for driving when business is slow?

February is one of the slowest months for business. The post-holiday slump has hit and people are trying to save money after spending so much during the holidays. Unfortunately, this means that your earnings as a Door Dash driver will probably take a hit as well.

First, take advantage of the slow period by doing extra prep work. This could mean stocking up on supplies, such as napkins, utensils, and condiments so that you’re prepared for when business picks up again. You could also use this time to clean your car and make sure it’s in good working order. This way, when business does pick up, you’ll be ready to hit the ground running – and make money!

Second, have a backup plan. If you rely on Door Dash as your primary source of income, then you should have a plan for when business is slow. While Door Dash is one of the most popular delivery services, it’s important to remember that they are not the only game in town. If you live in a city with multiple delivery services, make sure to sign up for all of them! This way, you can maximize your earnings by accepting orders from multiple platforms. Pick up extra shifts at your day job (if you’re able to), or find other ways to make money. It’s always a good idea to have multiple streams of income so that if one dries up, you have others to fall back on. If you’re only relying on Door Dash for your income, then you’re putting all your eggs in one basket.

Third, it’s important to save up money when business is good so that you have a cushion to fall back on when business is slow. A few ways you can do this is by extending your delivery service hours when there’s a high demand for drivers in your area; if there is a high peak pay incentive or promotion in your area; or when business appears to be busier than usual which is usually when people are at their hungriest, i.e.: lunchtime and dinner. Don’t overlook these unicorn cashflow opportunities; they’re rare and infrequent. Every order has a guaranteed minimum payout, but sometimes you may be able to make more if the customer adds on a tip or if there’s an incentive for delivery drivers in your area. When business is slow, every Door Dash order counts. This will help you stay afloat to cover your business expenses during low-tied and avoid going into debt.

Forth, you will need to learn how to analyze your profit margins while taking each and every order on the Door Dash Dasher app. Always factor in the distance (or mileage), the time it will take to do the delivery, and the restaurant that you’ll be picking up from. Each of these factors plays a significant role in your profit margins and will have a huge impact on your personal finance in the long run, when it comes time to file your taxes. So, it is important that you understand how to optimize each delivery to maximize your earnings.

When business is slow don’t panic. When you start to panic, you go into a scarcity mindset. When you operate from a scarcity mindset, you start making bad decisions and accepting things that don’t make any sense. Like accepting orders that don’t yield a profit.

Lastly, always do research to see whether your small business qualifies for disaster unemployment compensation or any further government assistance in the case of a natural disaster.

Here is the Disaster Unemployment Assistance (DUA) for the Texas Winter Storm Uri in 2021:

- https://www.fema.gov/sites/default/files/2020-07/fema_disaster-unemployment-assistance_fact-sheet.pdf

- https://www.twc.state.tx.us/jobseekers/disaster-unemployment-assistance

- https://gis.fema.gov/maps/dec_4586.pdf

So yes! An Independent Contractor with Door Dash is viewed as a business and should be treated as such and not a hobby. You’re not only a gig worker, you are an entrepreneur! Now let’s move on to debt repayment!

Total Door Dash earnings – February 2020 vs February 2021:

| February 2020 | February 2021 |

| $1,223.43 | $1074.98 |

My Student Loan Debt Repayment Journey:

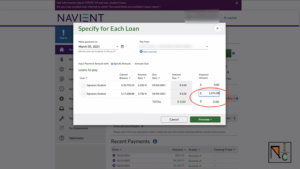

So at the beginning of this student loan debt payoff journey, my loan balance at the time was $18,548.61.

I have applied $1074.98 from all of my Door Dash side income, and now at the end of February 2021, my balance is $17,298.72.

It’s important to stay positive and remember that this is only temporary. Business will eventually pick back up, and you will be able to make money again.

Here’s what to look forward to in the warmer months:

- Daylight savings time! This gives the illusion of a longer day. If there’s a longer day, there’s a strong possibility for more orders because more restaurants are staying open longer.

Things that I’m not looking forward to:

- More competition. In order to fund their college education, college students do Door Dash as well.

- Educators who have the summer off join the Door Dash platform too, which means they’re also getting their side hustle game on while they’re on vacation!

With all of that in mind, the summer months are undoubtedly competitive. This may be tough to increase money during the warmer months. So take advantage of bonuses, peak pay times, and multiple order requests when you see them.

I hope these tips help you prepare for driving when business is slow. Door Dash can still be a great way to make extra money, even when business is slow. Just be sure to have a backup plan, save up money when business is good, and stay positive! Door Dashing can still be great even in the winter months. If you follow these simple tips, you’ll be on your way to making extra money towards achieving your financial goals or paying down student loan debt in no time!