This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

If you work in the gig economy, then you know that tax time can be a little confusing and if you’re keeping track of your mileage for your gig-work by hand, it’s feasible that you’re missing out on money in terms of taxable deductions. Fortunately, there are several tax deductions available to gig economy workers that can help reduce your taxable income and lead to a bigger refund. In this blog post, we’ll review a few apps that seem to be quite popular in the gig economy sector and how to get the most tax deductions possible for your gig-work.

Here are a few of the most well-known mileage tracker apps in the gig economy:

- QuickBooks Self-Employed: Mileage Tracker and Taxes:

With this app, you can automatically track your mileage and expenses so you don’t have to remember to do it manually. The app will also provide you with an estimate of your taxes so you can plan accordingly.

- Mile IQ:

This app provides the ability to log trips manually or automatically. The app will then categorize your trips as business, personal, or charitable so you can get the appropriate deduction.

- Everlance Mileage Tracker:

Available for both iOS and Android devices this app offers a free and premium version. The free version allows you to track your mileage and expenses, while the premium version gives you access to additional features, such as trip logging, categorization, and GPS mileage tracking.

- Stride Health:

Providing both a mileage tracking app and health insurance to gig economy workers; this app allows you to track your mileage, your business expenses, your business income, profit margins, estimated taxes, and get health insurance all in one place!

- Hurdlr:

Similar to the previous three, this expense tracking app includes a mileage tracker which provides a simplified interface for tracking mileage and business expenses all in one place.

How to determine tax-deductible expenses for gig-work:

There are several other mileage tracking apps available but those are some of the most popular ones in the gig economy. If you’re not sure which one to choose, try out a few different ones to see which one works best for you and your needs.

However, in this blog post, I’ll be focusing on the Stride Health App, which has been my primary method of keeping track of my mileage and tax-deductible expenses for the previous six years.

What are tax deductions?

A tax deduction is an expense that can be deducted from your taxable income. This reduces the amount of taxes you owe and results in a bigger tax refund.

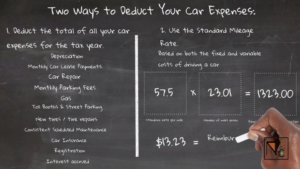

First and foremost, it’s vital to understand the various ways that a gig economy entrepreneur may deduct automobile costs on their tax return. The first is your total car expenses for the current year.

What are some of the automobile deductions you may claim on your taxes?

This includes (but may not be limited to):

- Depreciation

- Lease Payments

- Car Repairs

- Garage Rent

- Gas and Oil

- Tolls and Parking Fees

- Tire Replacement & Tire Repair

- Tune-ups

- Insurance

- Registration Fees

- Interest Accrued from Car Payments

The standard mileage rate is the second option for deducting vehicle costs on a tax return.

What is a standard mileage rate?

The standard mileage rate is a per-mile deduction that you can take for business, medical, or moving purposes. The standard mileage rate is the simplest method of deducting vehicle expenses on your taxes because you don’t have to keep track of your actual vehicle expenses. The standard mileage rate is set by the IRS each year.

How do you calculate the standard mileage rate?

To calculate the standard mileage rate, you simply multiply the number of business miles you drove by the standard mileage rate.

For example, if you drove 100 miles for business purposes and the standard mileage rate is $0.58, your deduction would be $58.00 (100 x .58).

Likewise, if you drove 20,000 miles for business this year, your deduction would be $11,600.00 (20,000 x .58).

This is a pretty significant deduction and it’s one that gig economy workers often overlook!

The standard mileage rate is calculated based on the average vehicle cost for the given year. So if you have a car that is less expensive to maintain than the average, it’s most likely you are making a profit.

How would you use the standard mileage rate?

If you use the standard mileage rate, you will need to track your mileage throughout the year. This can be done with a mileage tracker app on your mobile device.

You can only deduct the vehicle mileage rate if you didn’t already deduct your actual car expenses on your tax return. You also can’t deduct both the mileage rate and your actual car expenses in the same year.

The mileage rate is a great deduction to take if you use your personal vehicle for business purposes, but it’s important to keep track of your mileage throughout the year so you have an accurate number to input come tax time.

That’s where a mileage tracker comes in handy! A mileage tracker will automatically log your mileage for you so you don’t have to remember to do it manually. The Stride app computes the current year’s standard mileage rate, as determined by the IRS, without requiring any input from you!

Here are two different scenarios for claiming car expenses and standard mileage:

Scenario 1: You are driving your own personal vehicle and the company that you are contracted with is only paying you for your services and not for mileage driven. So take me for example, I’m using my personal vehicle to perform courier services on behalf of the Door Dash platform. Therefore I am responsible for keeping track of my mileage to report as a business expense during tax season.

If you meet the requirements outlined above, speak with a tax preparer to take advantage of this standard mileage rate tax benefit.

Scenario 2: This is for those who do not own the car they use for business. However, they still incur the expenses of operating it. This includes any maintenance, gas, or parking fees, and in this case, the standard mileage rate would not apply to this scenario. As the person behind the wheel is only operating it.

Now that you’ve learned about the two scenarios for deducting car expenses on your tax return, you can make an informed decision about which option works best for you and get the greatest return throughout the tax season. However, the most important step is to gather all of your documents together.

How to gather your car expense documentation for tax season:

If you’ve made more than $600 over the past year, doing your gig-work, you should have received a 1099 NEC. In prior years you would have received a 1099 Miscellaneous. The 1099 NEC is now what’s used to track independent contractor income.

What is a 1099 NEC form?

A 1099 NEC is an IRS form that is used to report non-employee compensation. This includes income earned from gig-work.

You’ll need this form to file your taxes as it will show how much you made from gig-work over the year.

What is a 1099 Miscellaneous form?

This form is used to report miscellaneous income from sources such as rents, royalties, prizes, and awards.

When do you receive a 1099 NEC?

The form will be mailed or electronically sent to you via a secured log-in portal between January 31st and February 15th of the new year from the company you are contracted with.

If you do not receive a form and earned more than $600 for the prior year, don’t panic!

Contact the company that you contract with and request a copy of the form.

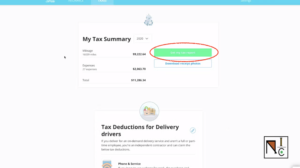

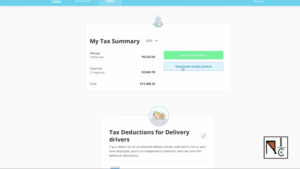

Finding your tax documents on the Stride Health App:

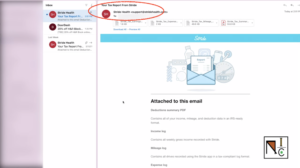

You can access all of your tax deduction documentation through the Stride App in two different ways. One is simply through your phone, and the other is by logging into a computer (desktop or laptop) using the same email and password use to access the app from your mobile phone.

On a computer: You’ll click on “Get my tax summary report”. Stride Health will then email you a copy of your report with a subject heading that says, “Your tax report from Stride”. Within the body of the email will be a list of the documents that are attached.

Which are:

- The Tax Summary PDF

- The Income Log

- The Mileage Log

- Your Expense Log

What is a tax summary report?

Your tax summary report is a year-end report that provides you with an overview of your total earnings, mileage deductions, and expenses for the entire year. This document is important because it will help you (or your tax preparer) determine how much money you owe in taxes or if you are due a refund.

Your Tax Summary PDF should provide you with a summary of the following information:

- It should show you the total take-home pay for your side-hustle or gig-work. However, this only happens if you’ve been recording your weekly income in the Stride Health App software.

- It will list all of your expenses in categories.

- Your deductible mileage for the year will be shown.

- Supplies that you purchased for your gig-work and any other additional expenses will be noted as well.

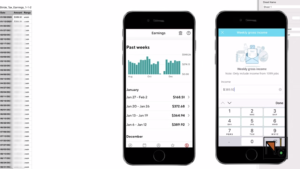

What is an income log?

Your income log is a report that shows your total earnings for the year. This document is important because it will help you (or your tax preparer) determine how much money you owe in taxes or if you are due a refund.

Your stride income log provides you with the following information:

- A full report from the beginning of the year to the end of the year of your weekly earnings.

This document is only going to be available to you, if you have been reporting in your earnings for the week from your gig economy app into the Stride App.

This is a great feature within the Stride App because if you are using Door Dash as a gig economy side-hustle, you may find that the Door Dash Dasher App only keeps track of the last four to five months of your income. After that, you may have to call customer service to retrieve that information. However, if you save your weekly earnings in the Stride App it will help you stay organized and avoided the hassle calling customer service.

What is an expense log?

Your expense log is a report that lists all of the business expenses you paid for out of pocket during the year. This document is important because it will help you (or your tax preparer) determine how much money you can deduct from your taxes.

Your expense log provides information on any additional expenses (outside of mileage) you paid out of pocket to run the business.

Which includes:

- PPE Equipment

- Branded Gig-Work App Shirts

- Delivery Equipment, Cup Holders, Hot Bags, etc.

- Cell Phone Accessories, etc.

What is a mileage log?

Your mileage log is a report that lists all of the miles you drove for business purposes during the year. This document is important because you can deduct a certain amount of money per mile driven from your taxes.

And your mileage log will list:

- The date, time, pickup location, and drop-off location for each order that you completed.

- Mileage for each delivery

- Your tax deduction value for each delivery

- Location details of each delivery

Keep in mind that the Stride Health App also keeps track of all of your receipts. You can log into the Stride Health App on a computer and then download all the photos into one document so that you have that readily available for your tax preparer if they need it.

Why are these documents important for your gig-work and your taxes?

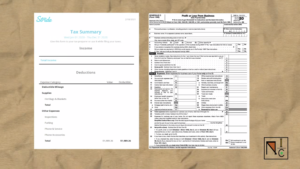

Your tax summary report is the most important tax document you’ll need for your gig-work because it is what you or your tax preparer, will pull information from to input on the IRS Schedule C Profit and Loss form when filing your taxes. The other documents we’ve covered are also very important because they serve as supplemental support for what your tax summary report states.

- The income log is important because it will show your total earnings for the year.

- The expense log is important because it will list all of the business expenses you paid for out of pocket during the year.

- And the mileage log is important because it lists all of the miles you drove for business purposes during the year and how much you can deduct from your taxes.

What is the IRS Schedule C Profit and Loss Form?

The IRS Schedule C Profit and Loss Form is the form used to report your annual income and expenses from your gig-work to the Internal Revenue Service (IRS). This form is important because it will help you determine how much money you owe in taxes or if you are due a refund.

The IRS Schedule C Profit and Loss Form has two parts:

Part I – Income

Part II – Expenses

In Part I, you will report your total annual income from your gig-work (found on line 1 of the Profit and Loss Form). In Part II, you will deduct all of the business expenses you paid for during the year to help lower your taxable income (found on line 31 of your Profit and Loss Form).

You will need to provide supporting documentation for both parts of the form. Your tax summary report, income log, expense log, and mileage log will all be used to complete the IRS Schedule C Profit and Loss Form.

So, what’s the significance of all of this?

If line 31 of your Profit and Loss form is higher than line 1 on the Profit and Loss form, you will report a loss on your taxes. And if line 31 is lower than line one, you will report a profit on your taxes.

A net profit from your gig-work is subject to self-employment tax. So, if you had a net profit for the year, you will owe self-employment tax on that amount in addition to income tax.

But this indicates that your small business is healthy and profitable!

If you had a net loss for the year, you may be able to deduct that amount from other sources of income (such as a full-time job) on your taxes.

However, this also indicates that your small business did not generate any profits during the past year.

Many gig-workers who were not eligible for the Paycheck Protection Program were turned down because their line 31 did not indicate a profit. To put it another way, the amount of money they spent on their gig-work was greater than the amount of money they earned throughout the year. It’s critical to track your mileage and how much money you’re earning when you’re driving as an Independent Contractor.

If you have any questions about what documents you need for your gig-work taxes or how to complete the IRS Schedule C Profit and Loss Form, please consult a tax professional.

What was the Paycheck Protection Program?

The Paycheck Protection Program was established by the CARES Act and implemented by the Small Business Administration with support from the Department of the Treasury. The bill was passed by the Senate by voice vote on April 21, 2020. The bill was then passed by the House of Representatives by a vote of 388–5 on April 23, 2020. President Trump signed the bill into law on April 24, 2020. The Paycheck Protection Program provided small businesses which included gig economy workers with funds to pay up to 8 weeks of payroll costs including benefits during the COVID-19 Pandemic; to help keep their workforce employed or cover the cost of business expenses as a result in loss of wages due to the COVID-19 lockdown in March of 2020.

And that’s it!

If you are self-employed and have gig economy income, be sure to keep track of these important documents so that you can get the biggest refund possible!

However please be sure to speak with a tax preparer or accountant to ensure that you are correctly reporting your gig-work income and expenses on your taxes.

And that’s everything you need to know about tracking your mileage for gig economy work to get a tax deduction during tax time so that you can get a bigger tax refund! Hope this article was helpful. If you have any questions, please feel free to reach out in the comments section below. Thanks for reading!

Resources Mentioned in Video:

- How to see how much screen time is used on certain apps to help you decide how to calculate how much cell phone expenses to deduct

- Apple Store Screen Time Tracker

- IRS Standard Mileage Rates

- IRS Standards for Adequate record keeping for your work

- The RideShareGuy’s Review on Different Mileage App Trackers

- Mileage deduction when you don’t own the car

- Mileage deduction when you’re married filing jointly