This post may contain affiliate links which means I may receive a commission for purchases made through links. I will only recommend products that I have personally used! Learn more on my Disclaimer Page.

Graduating during a recession can be difficult. Not only do you have to worry about finding a job, but you also have to start paying back your student loans. This can seem like an impossible task, but it is not impossible. There are many things you can do to start repaying your student loans after graduating during a recession.

In this blog post, I’m going to acknowledge how much student loan debt I have since I graduated during the recession.

Graduating during a recession can be difficult. Not only do you have to worry about finding a job, but you also have to start paying back your student loans. This can seem like an impossible task, but it is not impossible. There are many things you can do to start repaying your student loans after graduating during a recession.

In this blog post, I’m going to acknowledge how much student loan debt I have since I graduated during the recession.

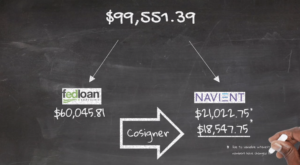

As of the recording of my first YouTube video, I have a total of $99,551.39 in student loan debt. That total is a combination of three different student loans, one federal loan, and two private loans.

This is a lot of money, and it can be difficult to even think about how to start repaying it. But, now that I’m in a financial place where I can start focusing more on paying down my student loan debt, I can share a few tips that may help you start repaying your student loans after graduating during a recession too.

How do you begin repaying down student loan debt?

The first part of solving any problem is to first acknowledge that you have one. So, the first tip I have for you is to take a deep breath and acknowledge your student loan debt. Look at your loans and see how much you owe. This may seem like an impossible task, but it is important to know where you stand before you can start making a plan to pay back your loans.

Next is to figure out your “Why.” What is your motivation for paying off your student loans early? For me, it’s to pursue my journey towards financial freedom and to share my journey with everyone interested in watching! I want to be able to travel and not have to worry about money. I also want to be able to help my family and friends if they ever need financial assistance.

Your why may be different from mine, but it is important to find your motivation for paying off your student loans. Once you figure out your why, it will be easier to stay focused on your goal of becoming debt-free.

The next tip I have for you is to establish a budget to be able to make overpayments monthly on your debt and then find an additional source of income if your debt-to-income ratio is high. You can find your debt to income ratio by dividing your total monthly debt payments by your gross monthly income.

What is a debt-to-income ratio?

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes towards debts, including your mortgage, car loans, student loans, and other credit card payments.

A high DTI means you’re using a large chunk of your income to make monthly debt payments and may have trouble making ends meet or qualifying for other types of loans.

How to calculate your debt-to-income ratio?

For example, if your monthly student loan payment is $300 and your monthly income is $2000, then your debt to income ratio would be 15%.

How do you know if you have a high debt-to-income ratio?

A debt-to-income ratio of 15% or lower is considered a good debt-to-income ratio. A debt-to-income ratio of 40% or higher is considered a high debt-to-income ratio.

For example, if you make $5000 per month and have $2000 in monthly debt payments, then your DTI would be 40%.

$2000/$5000= .40 or 40%

What to do if you have a high debt-to-income ratio?

Find an additional source of income to help you make overpayments monthly on your debt. You can find supplemental sources of income through freelance work, part-time jobs, or even starting a side hustle.

Over the last three years, I have been doing side hustle work, otherwise known as gig work in the form of being a Door Dash Driver part-time. I’m delivering food and using my car to provide an additional source of income. It’s been going relatively well, so this year I’d like to use the funds that I’m making from my Door Dash side income and not my primary income and apply all of that every single month towards one of my student loans.

Where to start first?

The next tip I have for you is to figure out which student loan you’d like to tackle first. Do you want to focus on the loan with the highest interest rate? The lowest balance? The loan that is going to be the easiest to pay off? There is no wrong answer here, but it is important to figure out which loan you want to focus on first. Once you have a plan, it will be much easier to start making headway.

For me, I am going to focus on my private student loan with the highest interest rate first. The added bonus is that this loan balance is the lowest of the three student loans that I have. Which makes the objective to pay off this loan more attainable in my mind.

The last tip I have for you is to make extra payments on your student loans every single month. Even if it’s only an additional $50-$100, those extra payments will start to add up and help you become debt-free sooner. You can also consider making bi-weekly payments instead of monthly payments. By doing this, you will end up making 26 half-payments throughout the year instead of 12 full monthly payments. This can help you become debt-free even faster!

If you follow these tips, you will be well on your way to repaying your student loans after graduating during a recession. Just remember to stay focused on your goal and to stay motivated. You can do this, I’m right there with you!

There you have it, those are my tips on how to start repaying your student loans after graduating during a recession. I will be documenting my progress every single month and recording and sharing tips and tricks each week about navigating gig work and setting daily earnings goals. What tips do you have? Let me know in the comments below.